If you have your business in any state of the US, that state will be the perfect place to establish your LLC. However, if you are doing business online or want to benefit as much as possible from the taxation laws of the US, then choosing a tax-friendly state like Delaware or Wyoming is the right move for you.

Five reasons why an LLC is the best structure for your business.

1. Flexible Profit Distribution Structure

Unlike Corporations which are required to have their profits distributed in exact accordance with the proportion of ownership of each shareholder. An LLC can split the profits among its members in different proportions to their ownership percentage; the complete flexibility of profit distribution is left to the members.

2. Avoid Double Taxation

An LLC follows what the IRS calls a ‘’pass-through’’ taxation. That means that the LLC doesn’t pay taxes directly; the profit or loss is instead passed on to the owner and later on taxed as a personal income.

3. The Limited Liability Protection

One of the most critical factors that drive people not to choose an LLC is security; by forming an LLC, the members’ assets are protected from any debts or liabilities that the company has incurred, the members are only responsible for the personal interest that they have invested in the business. The LLC is treated as an independent entity responsible for the full repercussions of its own financial, legal decisions.

4. Minimal Compliance Requirements

While the state requires that corporations would adopt bylaws, keep minutes of all the formal corporate resolutions, including the obligatory one meeting of directors and shareholders per year, LLC’s are not legally obligated to do any of those things; they are only required to maintain some annual filling requirements and certain formalities, which makes running an LLC much more accessible and more straightforward especially for startups and small companies.

5. Decision-Making Flexibility

When running a corporation like a c-corp, making changes to your company requires lots of bureaucracy; for example, when making board decisions like strategic and financial decisions, minutes are required by law from the board. LLCs have way fewer requirements and bureaucracy when it comes to making decisions.

Why choose us to get an LLC?

Transparency

Smart Biz Owner would never deceive or knowingly share false information with their clients for the sake of their profit.

Teamwork

Our team is constantly growing in numbers and experience because our priority is for our clients to receive the utmost care and attention.

What Documents do you need to set up an LLC in the US?

1. A Valid Passport

2. Phone number (US Number Preferred)

3. Email Address of the business

4. Postal address of the founder (Where you can get documents if mailed anything from the US).

5. Proposed Business Name

What You'll Receive?

1. You get a Delaware LLC or Wyoming LLC.

We offer company formation in the states of Wyoming and Delaware. Pick what’s best for you.

Smart Biz Owner will cover all state filing fees.

Once all mentioned documents are received it will 1-2 Business days to incorporate the company at your selected state of choice.

2. US EIN (Tax ID).

The Employer Identification Number (EIN) identifies the company to complete its federal filings, and to open bank accounts. Smart Biz Owner functions as an authorized third party to offer expedited EIN services to customers. You don’t need to be a US resident to get your EIN. No SSN or ITIN is required.

Once your US company is incorporated we will file for EIN to IRS, It will take up to 3-4 Weeks to get your EIN.

We do offer a third-party EIN filling solution and have 2 options for Expedited delivery:

1. 2-3 Day Delivery

2. Same-Day Delivery

You can contact us to know more about it.

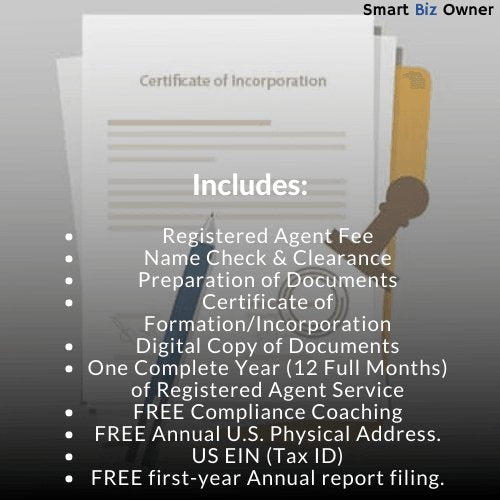

3. Bonus: Annual U.S. Physical Address.

You’re required to have one, and we will help arrange it for you.

Your US business address will be provided by the registered agent. It's free for the first year and included with the package for both Wyoming and Delaware companies.

4. A first-year registered agency fee is included.

In US business law, a registered agent is a company or individual designated to receive government notices.

We work with reputable registered agents based in Delaware and Wyoming to provide you with exceptional service. The first-year fee is built into our pricing.

5. Post-Incorporation Documents.

We will manually prepare a set of essential legal documents after incorporation. Post-Incorporation documents provide clear and necessary information about company owners, operations, and other vital details about the company once incorporation has been completed.

If you are confused Click the book a call now or contact us on WhatsApp down below ▽

Frequently Asked Questions:

1. LLC Name & Business Operations

• The name you choose for your LLC will remain the same across all official documents.

• However, you can operate multiple websites under your main LLC by registering a DBA (Doing Business As).

2. Postal Address Requirement

• A postal address is required to establish a legal presence for your LLC. This address will be used for opening a bank account, Facebook verification, and other business needs.

• If you have a notarized physical address, most banks and service providers will accept it, making the verification process easier.

Tax Liability:

• Simply owning a postal address does not create tax liability in the U.S.

• U.S. taxes apply only if:

• You or your employees are physically operating from the U.S.

• You own a warehouse in the U.S. (using a third-party warehouse does not create tax liability).

US Taxation detailed document: Click Here

3. Phone Number Requirement

• You must keep your registered phone number active.

• This number is linked to your bank account login and will be required for OTP verification.

4. Banking Options

We support the following banks for your LLC:

• Mercury

• Relay

• Slash

• Payoneer

• Wise

• Novel

• Brex

These banks offer fast support and a seamless UI, eliminating the need for a relationship manager.

Ownership & Security:

• Your bank account is 100% owned and controlled by you.

• Only you have access—no agents, no third parties, and not us.